Now that the world is coming to an end again (for like, what? the 4th time this year?) with this new Covid variant and lockdowns, markets going nuts and blah blah blah, we have P2P lending platforms acting out. For the last 3 to 4 months I've been consistently complaining about my P2P Loan platforms. You could say, that I complain a lot, and you wouldn't be wrong xD, but in this case I might have a valid reason. Late payments, drops in interest rates, cash dragging, etc etc are some of the symptoms I've noticed in the platforms I use. And now... to all these already bad issues, we can add FEES, yeah, Finbee is adding an account FEE!!! WTF Finbee!!! WTF!!!

Mintos

If you have read at least 1 of my now 7 monthly updates you already know Mintos isn't my favorite platform anymore (was it ever though?). Despite being a market leader, and perhaps one of the most matured platforms, it has become the target of my rage. Ok, yeah, they have been working hard in getting their licenses right, purging their lending companies and sending a ton of emails to the investors to warn them about their portfolios bad diversification levels. But something is off, they have been dragging my cash like nuts the last 2 months.

I think the first month that Mintos became a notorious (like Connor xD) cash dragger was around October. Actually looking at my metrics September showed some dragging for Finbee and Peerberry as well. However both Finbee and Peerberry allocated the cash right away, while Mintos just got worse and worse, reaching 27% dragging by the end of October.

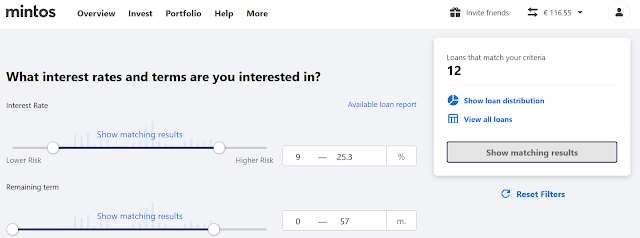

Today Mintos is dragging about €116 which now represents about 19% of the current portfolio, and there's still 4 days left in the month to increase my disappointment xD. Judging by the amount of available loans right now, that money is not going to get deployed any time soon.

Looking at Mintos published statistics, they are clearly in a downward trend for founded loans since September. Dropping by 3% in September-October and 1.7% October-November (source).

I am not sure what's going on with Mintos, but I'm not the first noticing such a thing. For example Angelo here in p2pinvestion.eu also mentions a very similar issue with Mintos as well.

Finbee

WTF Finbee!!! Yeah, this is a platform that is not as well known as Mintos or the other 3 I use, but has had a very reliable performance since I joined back in early 2020.Similar to Mintos, although with a MUCH smaller market, Finbee has been struggling to get loans in the platform, causing as expected some cash dragging as well.

What really concerns me about Finbee right now, is these "amazing" new features they have announced just a few days ago here. I mean, some of the features are interesting, but none of them scream innovation, they still don't have two factor authentication for example. Anyways, the features are not the problem of course, the problem is that with these features they announced they will be charging a monthly fee of €1 starting on February 1st 2021 to all the investors (except new investors for the first 6 months).

In their defense they are removing fees from the sellers on the secondary market, but how much money will they be making out of this? Well, looking at their website they claim to have roughly 21500 users, so starting on February 2021 they should be getting ca €20K monthly from these new fee. I wonder how many users will be backing off of the platform with this announcement. Honestly, €1 per month is a negligible amount if you have a few thousand euros invested there at a 10% to 12% annual yield.

Robocash

I wish I could complain about Robocash consistency, but heck no. Now... it is suspiciously consistent, and that's also odd.

Looking at my emails, I found the following

- March 2020 they announced 14% interest rate in ALL their loans!

- February 2021 they dropped to 11% on up to 30 days, and as much as 12.7% on 720 days loans.

- April 2021 they chopped them down again, 10.5% on up to 30 days loans and as much as 12.3% on 720 days loans

- And now in November 2021 they did it again! 10% on up to 30 days loans, and as much as 12.3% on 720 days loans.

No comments:

Post a Comment