Helloooooooo everyone out there in the vast Internet, welcome to Update #010, covering my finances for the month of January 2022. Can't believe I've been doing this for almost a year :O now, hello consistency, how are you, wink wink!!!

January was a good month, I must say though that getting back to work after the holidays was hard to say the least. The first 2 weeks were mental, oncalls delayed projects, jeeezzz, luckily things have taken a slower pace by now.

Have you seen the stock market during January? oh my, it felt like a freaking roller-coaster. we dipped 10% on 27th, and now looks like we are slightly recovering. However things aren't looking too good, looks as if we were starting to break previous lows and trending down. I guess in a few weeks or month we will have a better picture!

What am I doing? trying to pick stocks as they start dropping in price, but holding off on any big purchases for a few weeks at least.

P2P Update

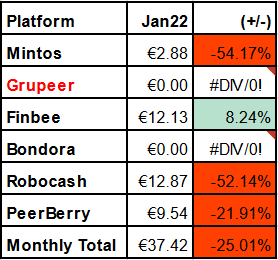

My P2P lending portfolio did ok, bad if we compare it with December but ok if we compare it with November. December was a bit of an atypical month in terms of returns, although I expect my portfolio to be yielding over €40 a month by now, €46 like December is a clear outlier caused by some delayed payments most likely coming from Robocash.

The strongest and more consistent platform remains being Finbee, so I'm very happy with that. Unfortunately starting this month (February) they will start charging a €1 fee to use the platform. I considered leaving them, but who am I kidding? is the best platform I have in my portfolio, so I'll take the bullet anytime. Mintos keeps disappointing as usual, however I've decided not to remove any more cash from the platform for now (I believe in second chances xD). Both Robocash and Peerberry also showed lower results, Robocash is normal after the peak in December, and PeerBerry seems to be caused by some loans being delayed, so nothing too crazy going on here.

Despite the 3 platforms return less than the month before, the annual avg yield managed to stay above 10%, BARELY reaching 10.04% hahaha, I can't believe it either.

It's been quite a challenge to keep this 10% yield, and particularly the last 3 to 4 months. Looking at the individual yields, both PeerBerry and Mintos seem to have dropped their yield a bit since October and that is dragging the portfolio down (you can see the interactive version of this graph in the P2P Portfolio section).

I won't be taking any immediate actions on this, but I will be keeping an eye to see if this doesn't improve. Maybe it's time to go out there and get a find a new platform to add to the portfolio.

Dividend Update

Let there be dividends!!! And dividends showed up xD, although not so many of them in January. In total I collected €21.84 in dividends, not too bad if you consider the same month last year only did €13.53 :), that's a good 1.6x yoy growth. The 3 bigger payers for the month were PEP, CNQ and JPM. January was also the weakest month on 2021, so chances are the same will happen for 2022.

Ohhh I miss September 2021 dividends...

Stocks Update

Man... things are falling down like mangos from a mango tree. Facebook (aka Meta) is down 27% as I write this, Paypal also got hit hard, and Amazon is down like 8% and it hasn't even reported earnings yet (xD went up almost 17% after reporting not so amazing earnings!)! Jesus Christ what a few weeks.

I did a few impulsive buyings in early January when a few of my price tech stocks started to drop.

- CRWD: bought 2 shares of stock of Crowd Strike, for $197.1 a piece (now at $170). This is a IT security company winning a lot of ground among big companies. They have been growing about 100% yoy the last few years, and although they are not profitable yet they have quite a bright future. Long term play.

- SQ: bought 2 shares of Square at $150.1 a piece (now at $102 ouch!). Payment processor you can find pretty much in any store by now, they have also being growing their revenue more than 20% to 30% yoy, and unlike CRWD, these are already profitable. Long term play.

- INTC: good old Intel, bought 10 shares at $55.1 (now at $48.72). I'm very confident Intel will make a return, right now is one of the cheapest chip makers out there in terms of PE and pays almost a 3% dividend!

As you can see the 3 buys are already looking kind of red, things got much worse in my portfolio with PLTR going down about 50% and now AT&T also took a hit as well. Things are looking a bit scary, but this means some nice opportunities are coming around the corner. You just need to be ready.

Overall passive income

January ended up returning €59.26, this represents a 55% yoy growth, pretty neat :). This returns, represented 2.29% of my 12 months rolling avg expenses and 2.55% of January's expenses. I'm still far away from the 5%, however this is the fifth consecutive month where the passive income covered more than 2% of my expenses so this seems to have become a base already :).

Monthly objectives review

As I "Promised" in my goals for 2020, in order to fight my natural procrastination instinct I decided to track more closely certain monthly objectives. These are minor things I want to hold myself accountable for, here they go!

- How much did I walk?

- I did not reach my target of 60Km, I walked 58Km during January. :(

- Did I get my 2 hours of focus for investment?

- No, I didn't get my 2 hours of investment focus time. :(

- What did I fix?

- After so long, I changed the strings of my acoustic guitar! It was such a huge change in the sound, that I really regret not having done it sooner. :)

- Did I work out 3 times a week?

- No, managed to get 2 squeezed per week. :(

1 out of 4! Not a great objectives crasher xD, but the whole point of this exercise is to see it and try to sort it out.

And that's about it for January, hope everyone is doing great. Cheers!!!

No comments:

Post a Comment